With 94,000 Google searches per second, search delivers very high intent traffic. By measuring your share of those intent signals, you can gain a reliable and predictive metric for brand share.

With accurate share of search data, you can answer important questions about your overall market strategy. How does your brand performance compare to that of your competitors? How do different brands within your own portfolio stack up against one another? How much available demand are you actually capturing?

Share of search can be used to predict demand for inventory planning purposes, for example, or to decide in which of your categories to launch a new product.

Here’s what you need to know about tracking your share of search.

A quick review of “share ofs”

Market share is the portion of a market controlled by a particular company or product. It’s usually calculated by dividing the total company sales by total industry sales. Relative market share indexes a brand’s market share against that of its leading competitor. Market concentration, a related metric, measures the degree to which a comparatively small number of firms account for a large proportion of the market. And finally, share of voice measures the percentage of advertising media spend by a company compared to the total media spend for a given product, service, or category in the market. Share of voice was once a go-to indicator for overall market share, but in digital advertising, accurately quantifying share of voice is impossible. Share of search offers a viable alternative.

To measure a brand’s performance against its competitors, however, it’s not enough to look at relative search volume. You also need to understand which terms your brand (and each of your competitors) are winning and how they stack up against one another. Done properly, share of search can give you all those insights and more.

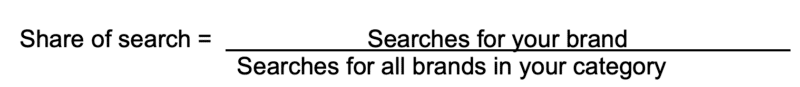

How to calculate share of search

Although it’s possible to generate share of search for a few brand terms from Google Keyword Planner, it’s not a scalable approach. Proper measurement requires:

- First-party data

- The ability to capture a set of branded terms (including brand-generics) within or across categories

- Market-level data

- The ability to segment by device

- The ability to segment by region or Designated Market Area (DMA)

- Search volume (either actual or relative) for your selected terms

With those components in hand, the ratio is straightforward

Use cases for share of search

Les Binet, who has studied share of search extensively, has identified it as a good proxy for market share (or imminent market share growth) because people generally seek information on things they already have or are about to buy.

That simple correlation is just the beginning. The array of use cases for the share of search metric is surprisingly broad because of the variety of ways you can set up which search terms to include. For example:

If you include brand terms only, share of search can provide:

- A reliable indicator/predictor of market share

- Validation that increased media spend is having a positive impact on market share

- Understanding of brand interest or momentum vs. competitors

- A predictor of revenue (depending on lead time)

If you measure a mix of brand and generic terms, share of search can provide:

- Understanding of the branded vs. generic search space across a category or sub-category

- For example: are customers aware of brands in the space? What proportion of searches includes generic terms vs. specific brands? Is your marketing influencing this ratio over time?

- Insights into whether your strategy is impacting your brand only or the whole space

- Exposure of opportunities and threats

- For example, let’s say you sell treadmills, rowing machines, elliptical trainers, and bike adapters for home gyms. You could measure generic terms across categories to assess relative search interest for those different product types and identify hot spots worthy of investment and promotion. With that benchmark in hand, you could also see over time whether your marketing activity drives an increase in search interest for your brand instead of generics or whether you have taken branded interest from other brands.

By measuring generic terms only, share of search can provide:

- Quantification of relative interest in different product subcategories within a category over time, such as gaming laptops vs. notebooks vs. PCs or whiskey vs. gin vs. beer

- Alerts to emerging trends in popularity, informing a wide range of decisions such as inventory management, marketing investment, or R&D

- A prediction of future demand by product type

The bottom line is that share of search provides a powerful tool for understanding your market, benchmarking your performance vs. competitors, and assessing if your search tactics and overall marketing strategy are having the impact you desire. Especially when you can measure your share of search by category, region, time, and location, you gain a very valuable new lever for growth.

Learn more about the share of search metric here.

The post How much of the market do you really own? appeared first on Search Engine Land.

Source: IAB