March has been a very challenging month around the world, and while marketers are not on the front line of the fight against COVID-19, we are fighting to keep our businesses going, and to keep traffic coming to our sites, or our client’s sites, in the face of an unprecedented situation. No matter how much time you took to plan strategies, model out scenarios and prepare your business for 2020, there’s no comparable situation that can offer any substantial direction to any marketer right now.

On March 11, COVID-19 was officially declared a global pandemic, since then various industries have seen swings in traffic to reflect the new reality, with those industries that serve news, entertainment, groceries, etc growing, and those that aren’t as necessary today as they were yesterday experiencing drops – hotels, sports sites, etc.

This article is going to look at two main industries to see how they’ve been impacted by COVID-19, the recreational vehicle market (excluding cars), and the commercial vehicle market, using data from Trader Interactive’s sites (full disclosure: my employer). In February, Trader Interactive purchased four vehicle marketplace sites from a former competitor, this means that for several of Trader’s sites, which have been optimized, there’s a comparable, unoptimized site for data validation (i.e., to somewhat offset the potential that changes in traffic are due to algorithm shifts due to prior work).

Recreational vehicles

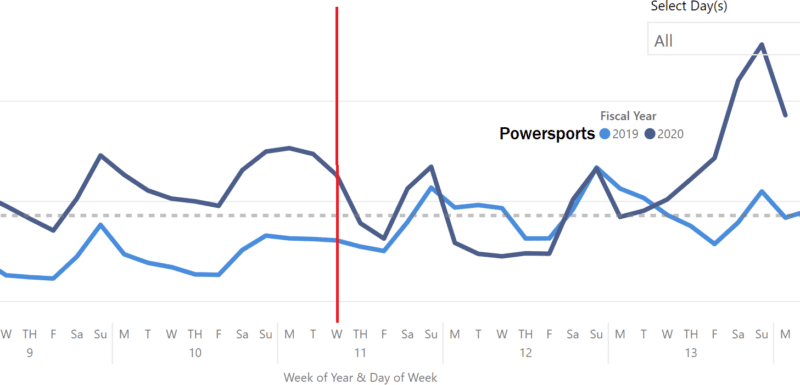

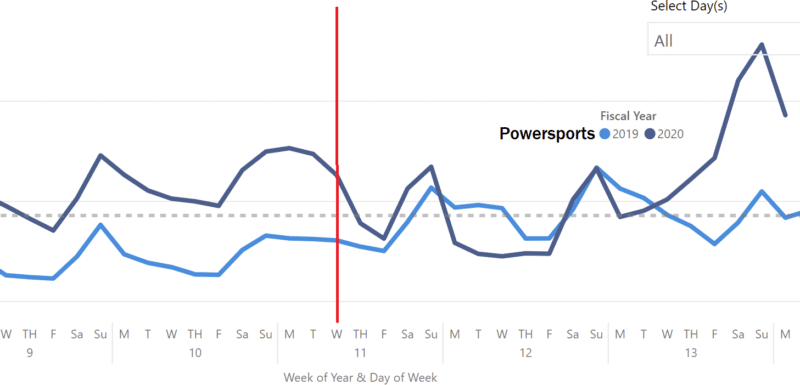

This first section has data that includes marketplace sites for motorcycles, ATVs, snowmobiles and personal watercraft. These sites were all ticking along nicely, up year over year, right up until that Wednesday, then the gap narrowed, and by the Monday was below the year over year numbers. The two weekends since the announcement have performed well, but from last Wednesday the traffic started to move back up, and March 29was an all-time record traffic day.

Leads to the sites did not increase at same rate as traffic, which indicates that people were doing more research on the vehicles, rather than pulling the trigger and purchasing. This makes sense, with the uncertainty in the world at this present time, and with the fact that one type of lead – phone calls – should be expected to be lower with the physical locations of some dealerships closed. That said, why are people even looking? Assumptions are:

- Escapism – many people are in isolation, and can’t wait for when they can get back out again

- Social distancing – motorcycles, ATVs, etc. are a great way to get out and still adhere to social distancing principles.

- Stimulus check – that Friday the COVID-19 stimulus bill was passed, which has a provision for money to be sent to individual Americans, based on income. Some people may have been looking at what they could spend that on.

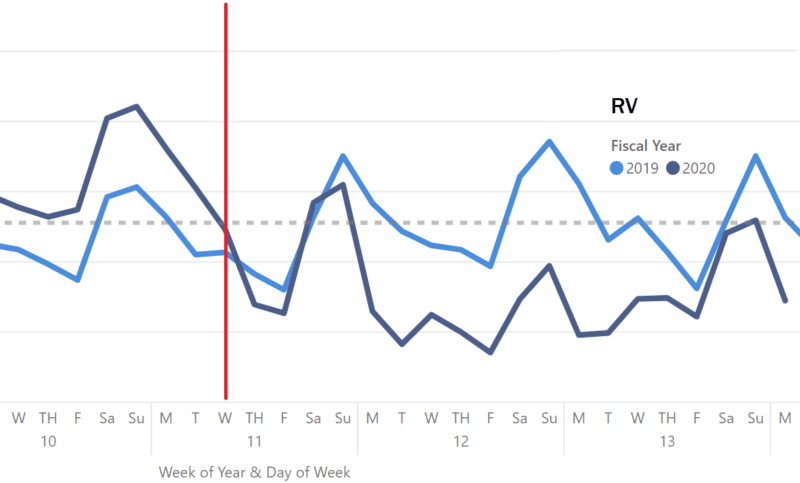

When looking at the data for the RV marketplace, which wouldn’t necessarily have the same motivations, as while you can escape in an RV, when allowed to travel, you’re most likely going to have to end up in a campground where social distancing is much harder. So while there was the same dip on March 11, and a narrowing of the gap last weekend, the traffic is still below. Another RV marketplace site I reached out to, expressed that they have seen a similar trend on their traffic, with some recovery over the last week but depressed year over year.

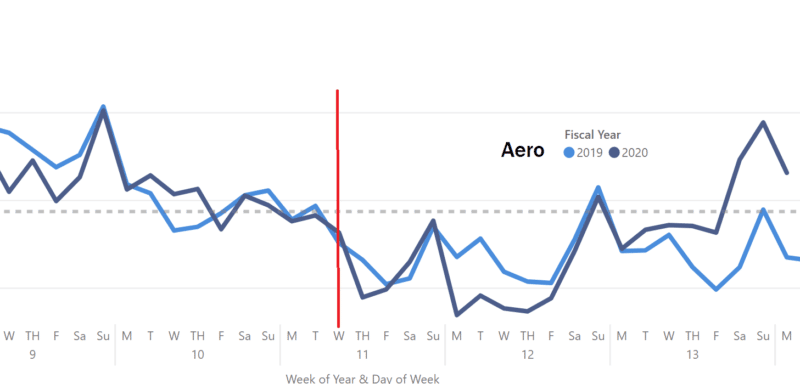

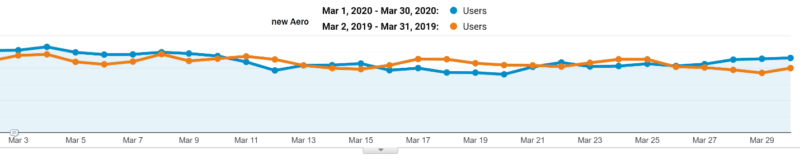

Aero, on the other hand, followed a similar trend to Powersports, going from level to the previous year, to below, after March 11, to above since mid-last week.

While this could have been an algorithmic change, we do have validation with another Aero site that came into the Trader Interactive fold in February, which shows a similar change, albeit at a smaller level of shift, indicating that this is more likely to be an industry-wide effect.

Commercial

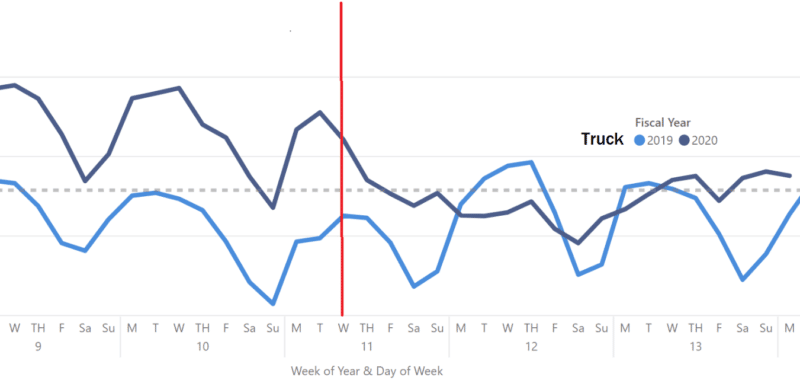

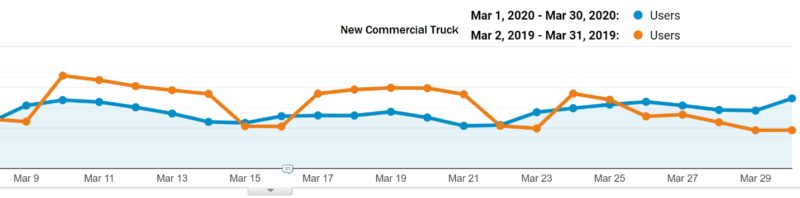

On the commercial side, there was a very similar dip, post announcement, with a recovery last week. The interesting thing here is that the peaks and valleys of weekends appear to have flattened, most likely due to the increased focus on the supply chain, where having a working fleet of commercial trucks has never been more important.

The newly acquired commercial truck marketplace site, which has not been optimized, also shows this flattening effect and increase over the last week.

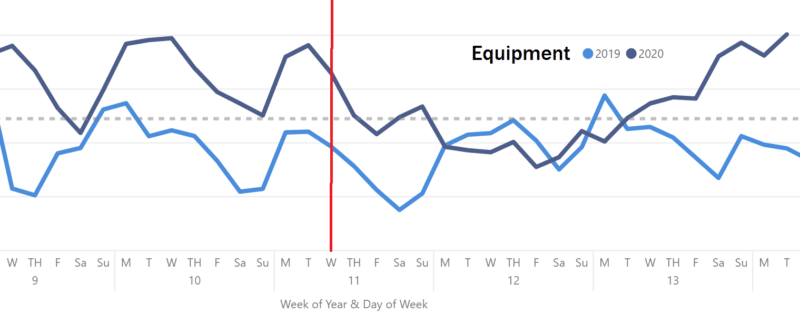

On the equipment side (construction and agricultural), the pattern also holds, with the usual weekend dips now flattened, however, it has actually returned to pre-March 11 levels (historically March has been the month with the highest levels of search traffic).

So, across all these different realms within this vertical, apart from RV, there’s a consistent pattern of traffic recovery, and in the case of Powersports of traffic increase, post the initial two-week traffic dip.

Only time will tell if this continues, especially given that the vehicle dealers are going to have to change how they sell the vehicles in the current environment in certain states (physical locations closed, limited number of people allowed on the premises, people reticent to potentially expose themselves to the COVID-19 by venturing out, etc.), but it does show that the demand for both recreational and commercial vehicles is still there, after a two-week hiatus, and needs to be serviced.

The post SEO for recreational and commercial vehicles in a COVID-19 world appeared first on Search Engine Land.

Source: IAB