“There’s a lot of variety here in terms of what businesses are growing and which ones are falling,” said Alexis Sanders, senior SEO manager for Merkle, referencing the striking departure from typical search behavior due to the COVID-19 pandemic during our first Live With Search Engine Land video chat Monday. “You can see with things that are very essential to people surviving and a work-from-home-type world, like groceries, they’re seeing massive lifts in performance for those about-eleven days year-over-year.”

Sanders shared the following click growth rates for a handful of Merkle clients between March 10, just three days before President Trump declared the Coronavirus outbreak a national emergency, through March 21:

- Large grocery retailer client: +433% YoY

- Bulk grocery retailer client: +58% YoY

- Large goods retailer client: +50.9% YoY

- Online messaging and productivity tool client: +149% YoY

- Hotel client: -43.3% YoY

- Theme park client: -55% YoY

- Chain restaurant client: -29% YoY

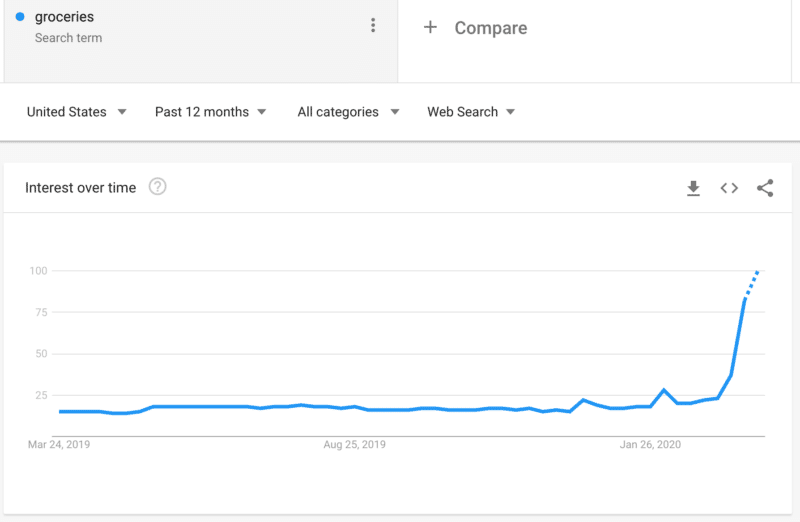

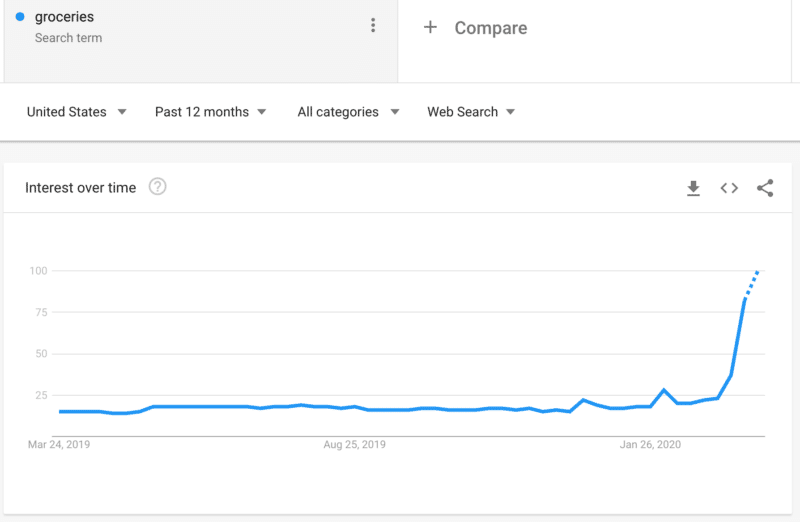

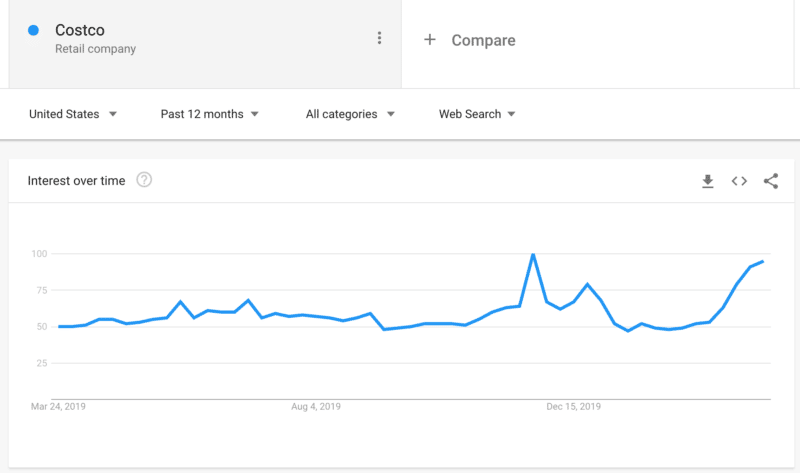

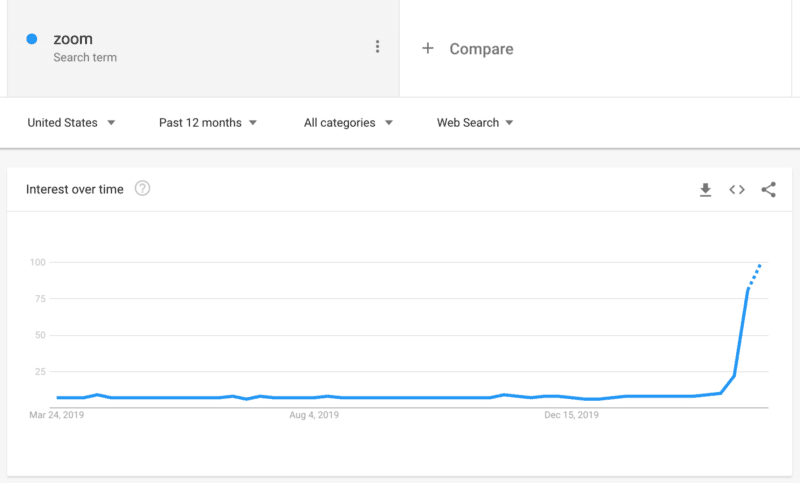

Search winners. Looking at Google Trends, we can see the dramatic surges in search volume around representative search terms in the grocery, bulk and online productivity categories that saw huge growth swings.

Social distancing measures have forced many to prepare food at home, and both Merkle’s figures and the Google Trends data for the keyword “groceries” reflect that. The Trends data shows an annual high for the week ending on March 21 — an increase of 446% compared to the same period in 2019. Related keywords, such as “online groceries” and “grocery delivery” also saw similar growth.

Perhaps out of fear or simply to prepare for long-term self-quarantining, big-box retailers, such as Costco, Sam’s Club and BJ’s Wholesale Club are also being searched significantly more than they were in March 2019. Costco’s search interest is up 82%, which is just 5% lower than its peak interest during Black Friday 2019.

With shelter-in-place and similar orders in effect in many of the nation’s densest areas, businesses have shifted to allow their employees to work from home.

This is clear in the Trends data for Zoom, Skype, Google Hangouts and Free Conference Call, which all achieved their highest search interest in the week ending on March 21, with year-over-year growth ranging from 270% (in Skype’s case) to 1057% (for Zoom).

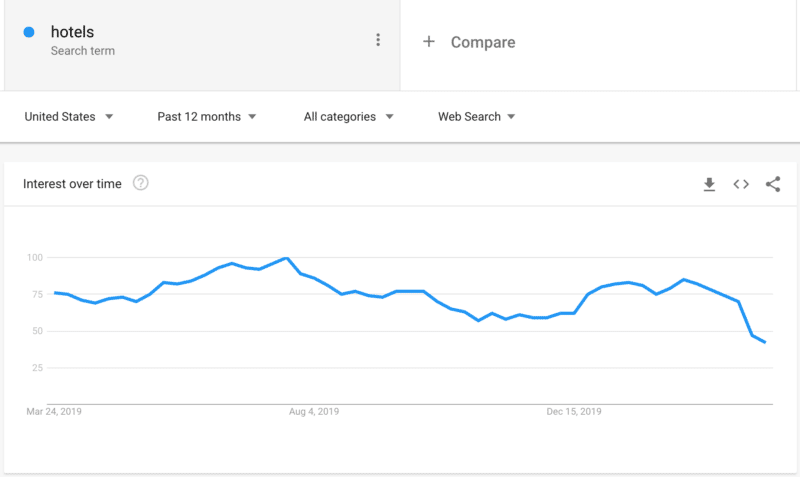

Not winners. Merkle’s data also shows that click growth shrank for their clients in recreational industries such as hotels, theme parks and chain restaurants.

With limits on how many people can gather in a given area, many in-person events such as conferences have moved online and travel plans have been postponed or canceled.

Consequently, interest in “hotels” decreased by 37%, which is not too far from Merkle’s figure (43%). The keywords “Disneyworld,” “Six Flags” and “Universal Studios” have also decreased in popularity by 21%, 68% and 73%, respectively.

Even local businesses, such as dine-in restaurants, are drawing in less search interest year-over-year, with Denny’s seeing a drop of 13%, IHOP decreasing by 18% and TGI Friday’s falling by 38%.

Why we care. Search behavior is a reflection of users’ priorities, and it’s clear that people are now more focused on the essentials and hunkering down for the long haul, as opposed to leisure activities such as traveling or dining out.

This is an unprecedented situation and businesses of all types are feeling the impact. It’s uncertain how long this will be the status quo, but given that stay-at-home measures are likely to continue for several weeks, if not months, businesses will have to adapt to accommodate their customers’ new needs and find new solutions for their remote workforces.

The post Winners and losers: How COVID-19 is affecting search behavior appeared first on Search Engine Land.

Source: IAB