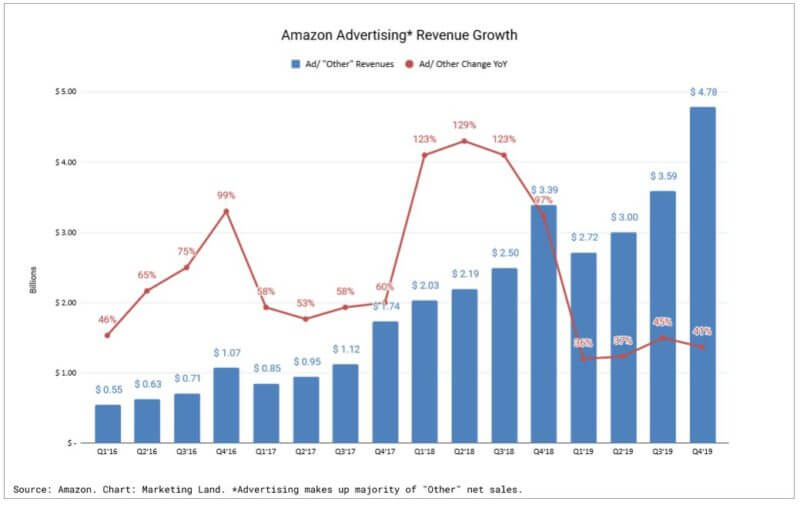

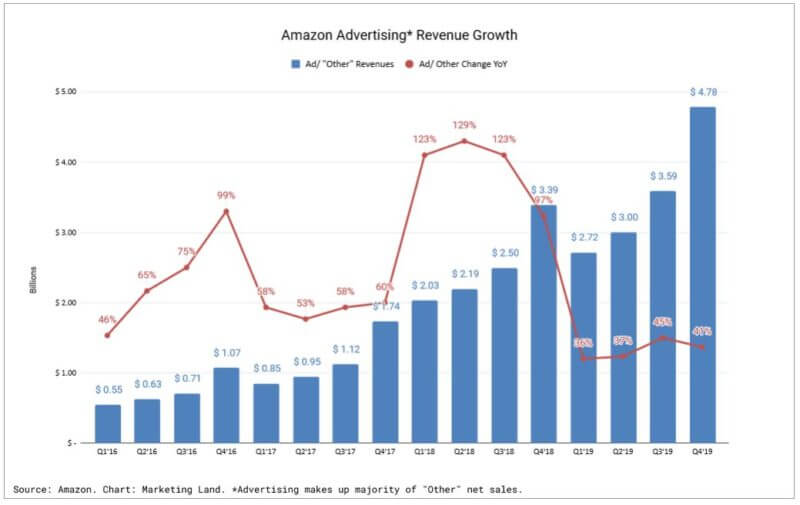

Amazon had anticipated a good holiday season, and it got it. The company reported $87.4 billion in net sales for the fourth quarter of 2019, up 21% from the same period the prior year. On the advertising front, the company generated ad revenues of nearly $4.8 billion for the quarter, an increase of 41% year over year. That brings the company’s annual advertising revenues in 2019 to roughly $14.1 billion, up 39% from $10.1 billion in 2018.

Amazon’s advertising business makes up the bulk of what it reports as “Other” net sales. “Advertising as a subset has been growing at about the same rate year-over-year in the fourth quarter than it did in the third quarter,” David Fildes, director of investor relations at Amazon, said on the earnings call last week.

Tools for brand advertisers. In response to a question about brand advertising initiatives, Fildes said the company is putting a lot of focus on “brands as an advertising customer set” and noted Stores and Posts among the efforts aimed at helping brands “better tell customers who they are” and help “customers discover products and brands.”

One-day shipping. Amazon also said it expects more marketplace sellers to jump on one-day shipping. “I think what you’re seeing is more and more participation of third-party sellers in our one-day delivery program as we move through the year,” said CFO Brian Olsavsky, in reference to steady growth in Amazon’s third-party seller services segment. “That was particularly strong in Q4, and I think you’ll see that more as we move into 2020.” The segment grew 31% year-over-year to $17.4 billion, up from 13.2 billion in the previous quarter.

Why we care. Amazon’s one-day shipping program is put pressure brands’ own direct-sales channels as well as on other e-commerce retailers to keep up, including Walmart, which is focused on building up a marketplace advertising business of its own.

The ability to directly tie advertising to sales on Amazon has been a key attraction for advertisers. “I think they appreciate the fidelity we can provide around shopping outcomes,” Fildes said on the earnings call, adding, “We’re uniquely positioned to do this given our retail business.”

Last quarter, Amazon expanded its sponsored display ad beta to more countries and introduced additional tools such as genre blocking and audience guarantees for OTT advertisers.

This story first appeared on Marketing Land. For more on digital marketing, click here.

The post Amazon’s booming ad business grew by 40% in 2019 appeared first on Search Engine Land.

Source: IAB